Global air merchandise sizes +4 per cent grew On an annual basis in April, but with the removal of the minimum shipping threshold from China to the United States, e -commerce sizes are expected to be hugely in the coming weeks and the tremendous certainty attached to the level of the macroeconomic economy, the question of the air freight market in 2025 has become “bad?

Over the past ten years, American consumers have not paid any duty of $ 800 or less charges, causing the size of the boundaries to the United States to about 1.35 billion similar (but less) exemptions in other countries. From today (May 2), products of low value obtained from China and Hong Kong to the United States will now be subject to 145 % of the new customs tariff, with products obtained from postal services that pay different fees by 120 % on the value of goods or fixed fees worth $ 100, and rises to 200 dollars on June 1.

Nearly 50 % of the Chinese-US-United States airbare shipments are e-commerce, which represents about 6 % of global sizes. It is likely that the low demand for planning for transport companies is likely to challenge, as early signs already indicate the cancellation of the charging aircraft and potential republishing to other commercial corridors.

One of the e-commerce giant in China, TEMU, has already responded by reducing its advertising spending significantly in the United States, but expectations for the global air charge-which depends on e-commerce income over the past 2-3 years since Covid-exceeds the American borders.

“This is a double -edged sword. “The decrease in the demand for one of the main corridors between Asia and the Pacific and North America will have a major impact, but it will also re -spread capabilities globally,” he said.

“This year may be when we get tired of seeing the word” unprecedented “in market performance data. The total economic image will depend on the period in which uncertainty continues and what will be at the end, but the future look seems very arduous.

“This is not related to one industry affected. This is related to the influence of the main commercial corridors, and we have not seen anything on this range before,” added Van De Wouw.

The weakest demand in the market in April and pressure on prices

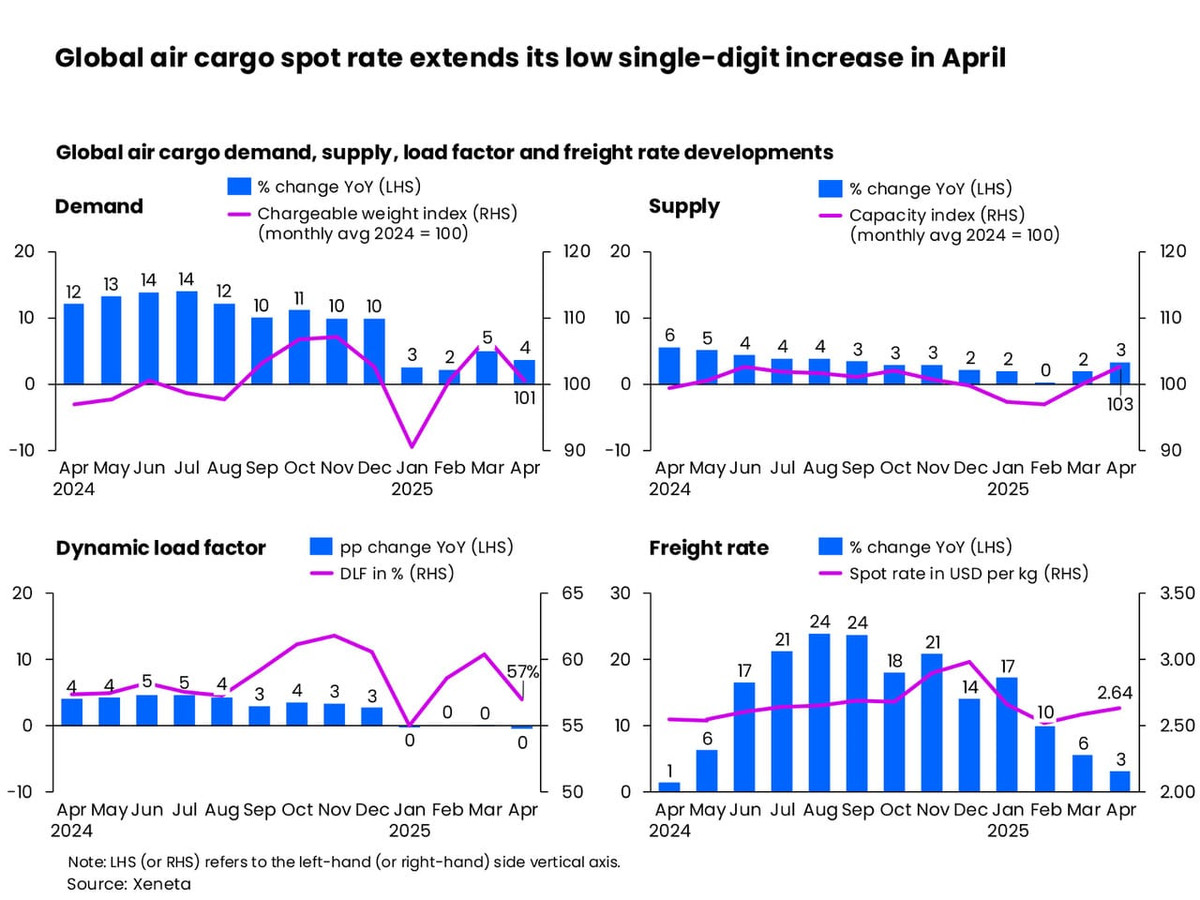

In April, gThe price of the severe air cargo spot increased +3 % on an annual basis, a second consecutive month of the number of only one. This slowdown is in line with weaker demand trends. In addition to the downward pressure on prices, jet fuel prices decreased by -24 % on an annual basis in the first three weeks of April. This decrease is likely, driven by a lot of continuous economic and geographical suspicions, may play a role in mitigating the growth of immediate calories in general.

Meanwhile, the available capacity increased modestly, an increase of +3 % compared to April 2024, and the dynamic loading factor decreased three degrees per month to 57 %. The dynamic loading factor is XENETA measurement to use the capacity based on the size and weight of the shipping that is transferred to the available capacity.

The US tariff measures that were implemented on the country’s alleged liberation day on April 2 prompted the rush of air charges from several Asian countries to North America. This led to a digital increase in both size and locations. It is worth noting that the immediate prices from Southeast Asia to North America jumped +13 % on the basis of the month, while those increased from Northeast Asia +10 %. However, these gains began to reflect in the second half of April after announcing a 90 -day tariff and +145 % of the revenge tariff for China.

The largest monthly increase in the North American Corridor – Northeast Asia has been observed, rising +14 %. This was largely driven by the trucks who rush to exports to China and Hong Kong amid fears of mutual definitions.

Elsewhere, the prices between the Middle East, Central Asia and Europe remain fame in one month, but it has decreased especially to Europe (-26 %) on an annual basis, reflecting the supply pressures from mitigating the previous red marine disorders. Meanwhile, the transatletic water rates decreased by -7 % of March, with its impact on increasing the abdomen capacity of the summer flight schedules, as well as the seasonal slowdown during Easter holidays and possible US tariff measures.

In the northeastern corridor of Asia-Europ, FRONHAL rates in Europe witnessed a slight increase in one month and rose +10 % on an annual basis. However, links to northeastern Asia decreased sharply, a decrease of -17 % compared to April 2024, as trade imbalances continued.

Waiting to know how bad the matter

Van de Woo said that the April market data has failed to provide many indicators for this year because it is not certain since the beginning of the month “was paid.”

“Nothing has already changed last month. The global air freight market is in an intermediate condition. It is very difficult for companies to transfer their sources to avoid definitions, but they are looking for ways to reduce the impact, and still do not know the final impact. The big question for everyone is what will do this year?

“The minimum change in the United States will disrupt the market and we will see its impact at the May numbers. I would like to say that you are ready for logistical chaos.

“I wonder about the number of consumers who we realize that there was a minimum base, and it has been canceled now. But this is about to change. One of his colleagues in industry from Cirrus Global Advisors in the United States earlier this week, was the“ most item ”from China, and its repair, which is what he declares, on the health, was identified. China ended,“ Fan Di Wu continued.

After the demand for the atmosphere market from two numbers in 2024, predictions in 2025 expected another 4-6 % growth year on an annual basis. He said that any attempts to restore expectations in the current market conditions will be “meaningless.”

Will the tariffs stick?

“The probability of low air rates is better news for the two trucks and the charges of the trucks, but if the trucks are unable to sell their goods due to the definitions, this is bad news about the total economic image and the need for air conditions. For most flying air shipments, low -definition prices will not be compensated for.

“Therefore, it is still a waiting game to find out the time that this process takes and arrange the size with which the definitions will stick to,” the Van De Wouw stated.

Now he added, all eyes on e -commerce.

“It is very likely that this calm will be before the storm. If the preparation of the new minimum remains-and why do they change it after the investment that the authorities have been reports-this will negatively negatively affect air sizes from China to the United States. The two trucks around the world will see more capacity (returning) to their market-but they still need life trading conditions to enjoy this in favor of this The opportunity.